Whether looking to get exposure to and/or complement existing holdings, our product suite benefits investors seeking to:

Increase Monthly Yield

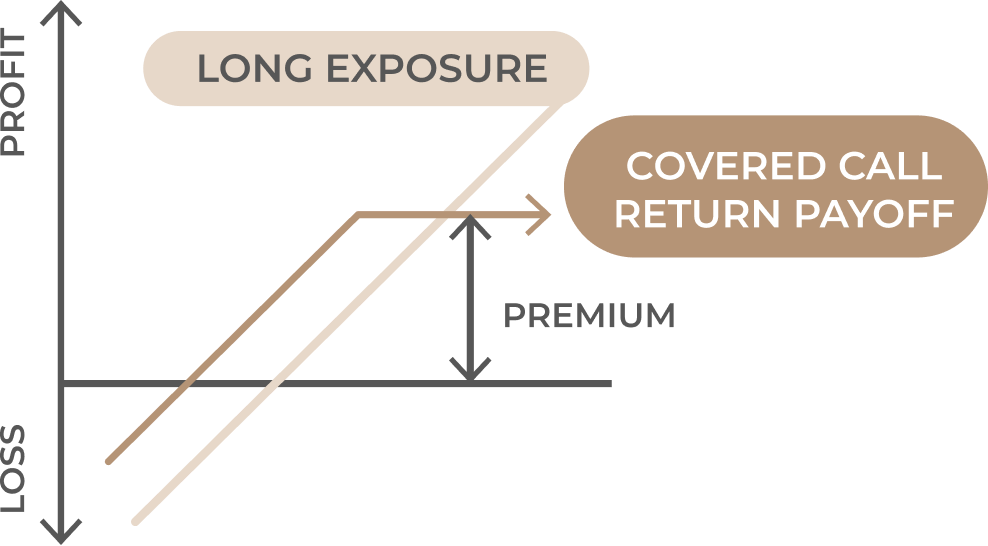

With its covered called strategy and moderate leverage, Yield Shares helps investors who are looking to maximize the monthly yield in their portfolio.

Avoid Currency Risk

All U.S. exposure is hedged back to the Canadian dollar, providing an effortless way for investors to purchase U.S. equity securities without the added foreign-exchange risk.

Enhance Tax Efficiency

The yield generated by Yield Shares is tax-efficient (primarily through capital gains and return of capital distributions), helping investors minimize the amount of income tax accrued.

Stay informed with Purpose

Sign up to join our community and stay updated with Yield Shares news, upcoming fund releases, and more.

You've got questions and we've got answers.

* Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. The prospectus contains important detailed information about the investment fund. Copies of the prospectus may be obtained from purposeinvest.com. Please read the prospectus before investing. There is no assurance that any fund will achieve its investment objective, and its net asset value, yield, and investment return will fluctuate from time to time with market conditions. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Fund distribution levels and frequencies are not guaranteed and may vary at the sole discretion of Purpose Investments.

This is for information purposes only and is not intended to provide investment, tax or other advice and should not be relied on as such. The information is not tailored to the needs or circumstances of any investor. Information contained in this document is believed to be accurate and reliable, however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

** This figure represents a single distribution from the fund and does not represent the total return of the fund. Distributions may vary, subject to the sole discretion of Purpose Investments.