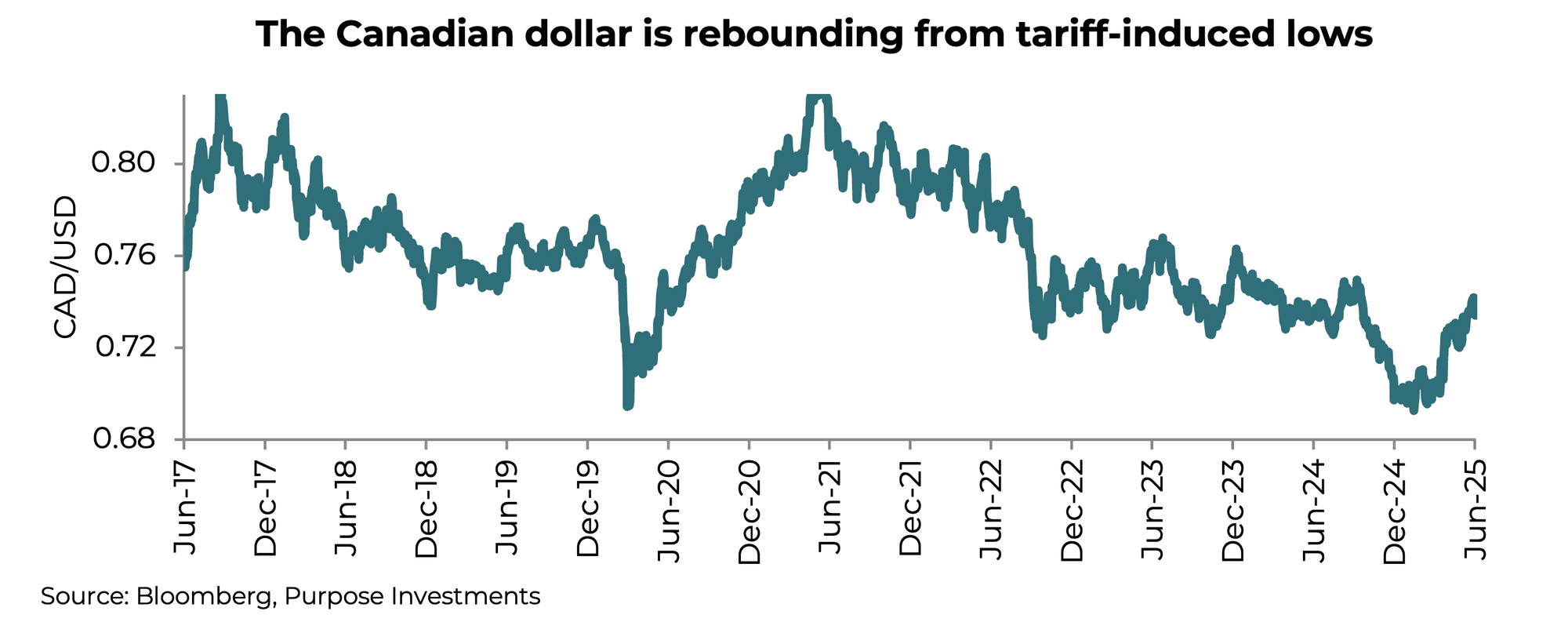

The U.S. dollar (USD) has lost about 5% of value relative to the Canadian dollar (CAD) so far this year, while the trade-weighted USD has dropped 9%. All else being equal, that means any U.S.-denominated investments have faced a 5% headwind so far in 2025 for Canadian investors, assuming they’re unhedged.

This has led to a recurring topic in recent conversations on currency, specifically whether or not to hedge U.S. dollar exposures. This isn’t a moot point, as there are many different considerations beyond whether the CAD at 73 cents is going to 75 cents or back down to 70 cents.

Accurately forecasting where a currency is going to go next is rather challenging. Additionally, for a Canadian’s portfolio, there are multiple other considerations when it comes to the question of hedging. USD exposure can have a portfolio diversification benefit, and there are many longer-term trends that should be considered. Below, we share our views on all these aspects and our current thoughts on currency hedging.

Portfolio Diversification

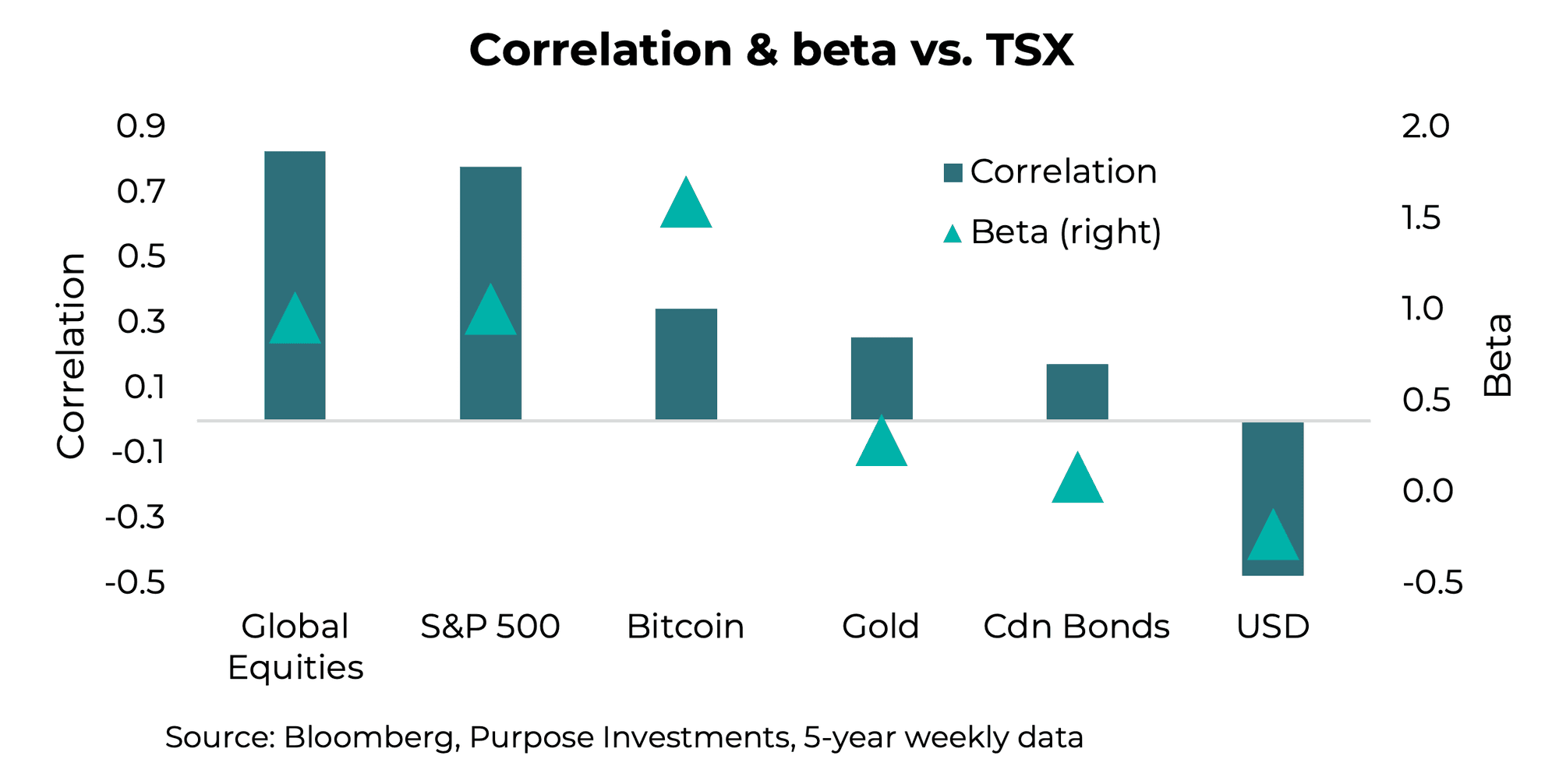

For Canadian investors – who are most of our readers – the USD looks fantastic! The TSX and the Canadian dollar are risk-on assets; both are more sensitive than many others to trends in global economic growth. When growth improves and markets become more risk-on, Canadian equity and currency tend to win.

Conversely, when growth slows or recession risks rise, the TSX and CAD tend to fall while the USD rises. Even if you dislike policy coming from America, the USD remains a safe-haven currency. If markets go risk-off, money tends to flow back to America, bidding up the currency.

As a result, U.S. dollar exposure often acts as a ballast for Canadian investor portfolios, even more so than bonds. The following chart shows the correlation of various investment vehicles to the TSX. USD exposure carries a negative correlation. Additionally included in the chart is the beta, as this helps demonstrate the size of the relative moves, not just the direction. Again, USD stacks up very well as a diversification tool for Canadian portfolios.

These numbers look similar over longer periods as well. So, this could support not hedging, given the diversification benefits. But there are other considerations as well.

Long-Term Trends

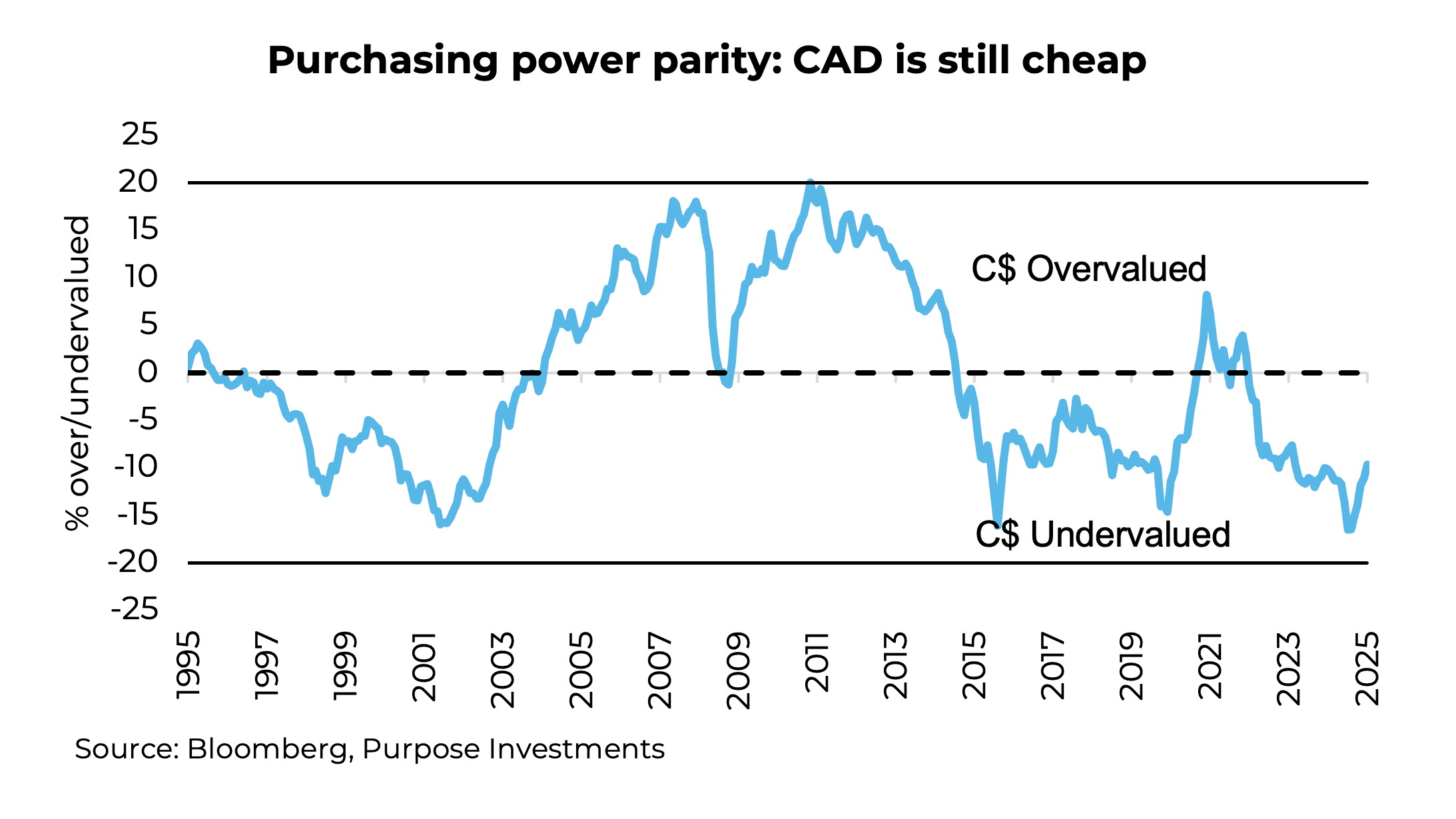

It’s very difficult to put a valuation or fair value on a currency exchange rate. Variations in economic activity and shorter-term interest rates certainly drive exchange rates over subsequent months or quarters. Much longer-term purchasing power parity does play a role, but you’ve got to look really long-term. If a currency is very cheap in one country compared to another, capital flows and trade will gradually reverse the spread (this happens more reliably with developed nations’ currencies). The freer the flow of capital, the faster the process; the more restrictions, the slower it goes. But it is not fast either way.

Even after the recent rise in the CAD vs USD so far in 2025, we believe the CAD is still cheap or undervalued. But it has been for most of the past decade, as it was overvalued for the previous decade. These are very long and slow-moving cycles. Taking a really long view, the CAD was a dog during the ‘90s, the USD was a poor performing currency in the ‘00s, and then the CAD sucked again in the ‘10s to 2025 so far.

If it’s a coin flip as to which currency performs better in the next five or ten years, we might say it is a well-loaded coin in favour of the CAD. But there are likely many moves in both directions during that period, some that align with the potential longer-term trend and some that are countertrend. We believe a long-term trend of a weaker USD and strong CAD might support hedging USD exposure.

Near-Term Factors

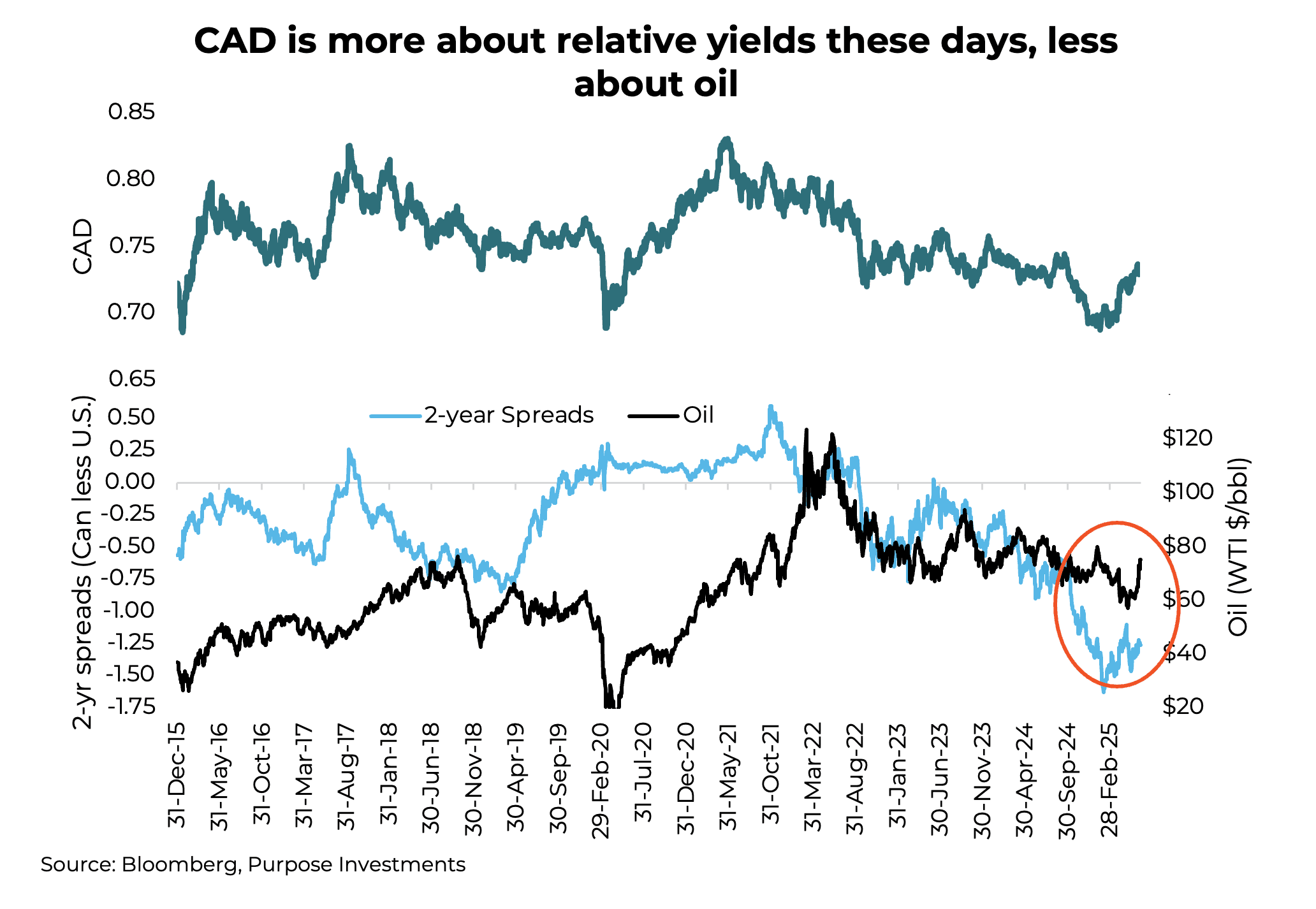

And then there’s the rest of the factors, MANY factors, driving near-term volatility in exchange rates. The CAD has often been influenced by oil prices, but this relationship was stronger pre-2020 than it has been lately. Conversely, changes in short-term relative yields between Canada and the U.S. have become a larger determinant. A narrowing of the spread between two-year yields has supported the Canadian dollar rebound, as has the spike in oil prices as Middle East conflicts intensify.

Add cooling uncertainty on the path of tariffs, halving the quantity of short CAD futures contracts, and a minor ‘anti’ U.S. theme in markets, and we believe the CAD bounce has many supporting tailwinds.

These are all known knowns in the currency world, and likely reflected in the recent weakness in USD and strength in CAD, which rallied from below 70 cents to the current 73-cent level. So, in the near term, it really comes down to what happens next. If we get more clarity on tariffs, we could see more CAD strength. If we see economic data continue to decelerate, we could see USD strength. Or some other aspect could rise up to move exchange rates in a way that surprises everyone.

Final Thoughts

So there you have it: no simple answer to this difficult question. From a portfolio construction perspective, we believe you shouldn’t hedge just because you want that diversification benefit. From a likely long-term trend perspective, the USD could weaken, supporting hedging. Near-term factors are noisy.

We would only act on these factors when things move too far or too fast. At 73 cents, we are rather ambivalent; it’s too high to get us excited about adding any USD currency hedges, but not high enough to entice us to remove any existing hedges.

In other words, a lot of words and charts just to say we are rather neutral.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L.P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,”“will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.