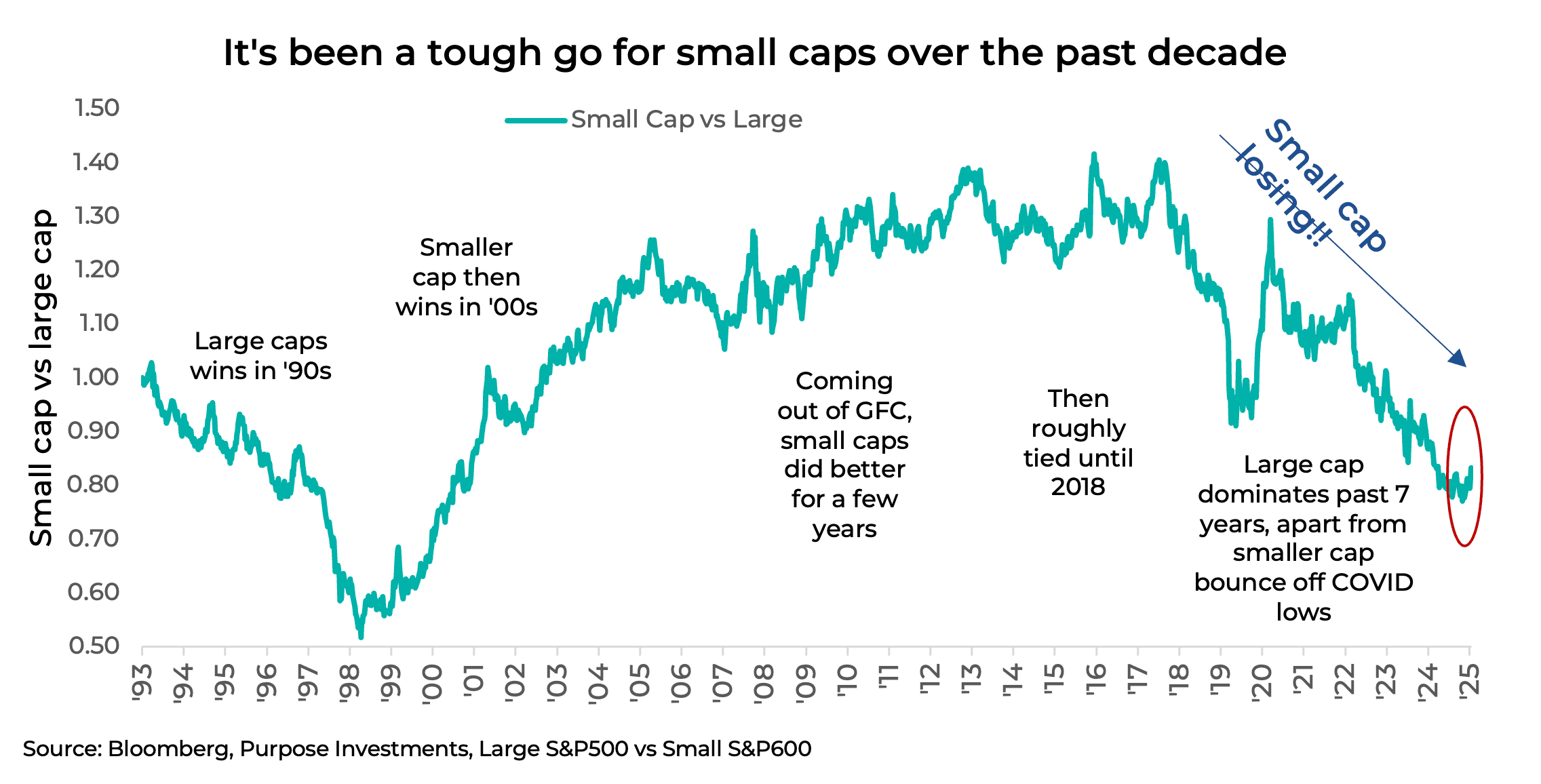

We cleaned up the Alfie Solomons quote from Peaky Blinders a little to make it PC, but when it comes to large-cap versus small-cap equities, it sure feels like big always wins. That certainly has been the trend for much of the past decade, other than a few brief periods where relative performance flipped temporarily.

It wasn’t always this way; in fact, there are many well-researched papers extolling the virtues of the size premium, meaning small caps should outperform over time. But you do have to look back pretty far to see or enjoy this premium.

But it’s January, and the start of a new calendar year, which typically has folks asking, “Is this the year for small caps?” And January often sees a rally in lower-quality stocks, which is a factor more prevalent in small-cap indices. So here we are, midway through January, and the S&P 500 is up +1.5% while the S&P SmallCap 600 is up +7.3%, encouraging more to ask the question.

We haven’t been fans of small-cap equities for some time, and we currently have minimal exposure outside of growth strategies. And we wouldn’t ever consider adding small caps in mid-January, given that the pop that usually starts the year has often proved fleeting. However, there are some encouraging aspects to small caps, and some discouraging aspects. Here’s our take on U.S. small caps:

Fundamentals: The Strength of Small-Cap Valuations

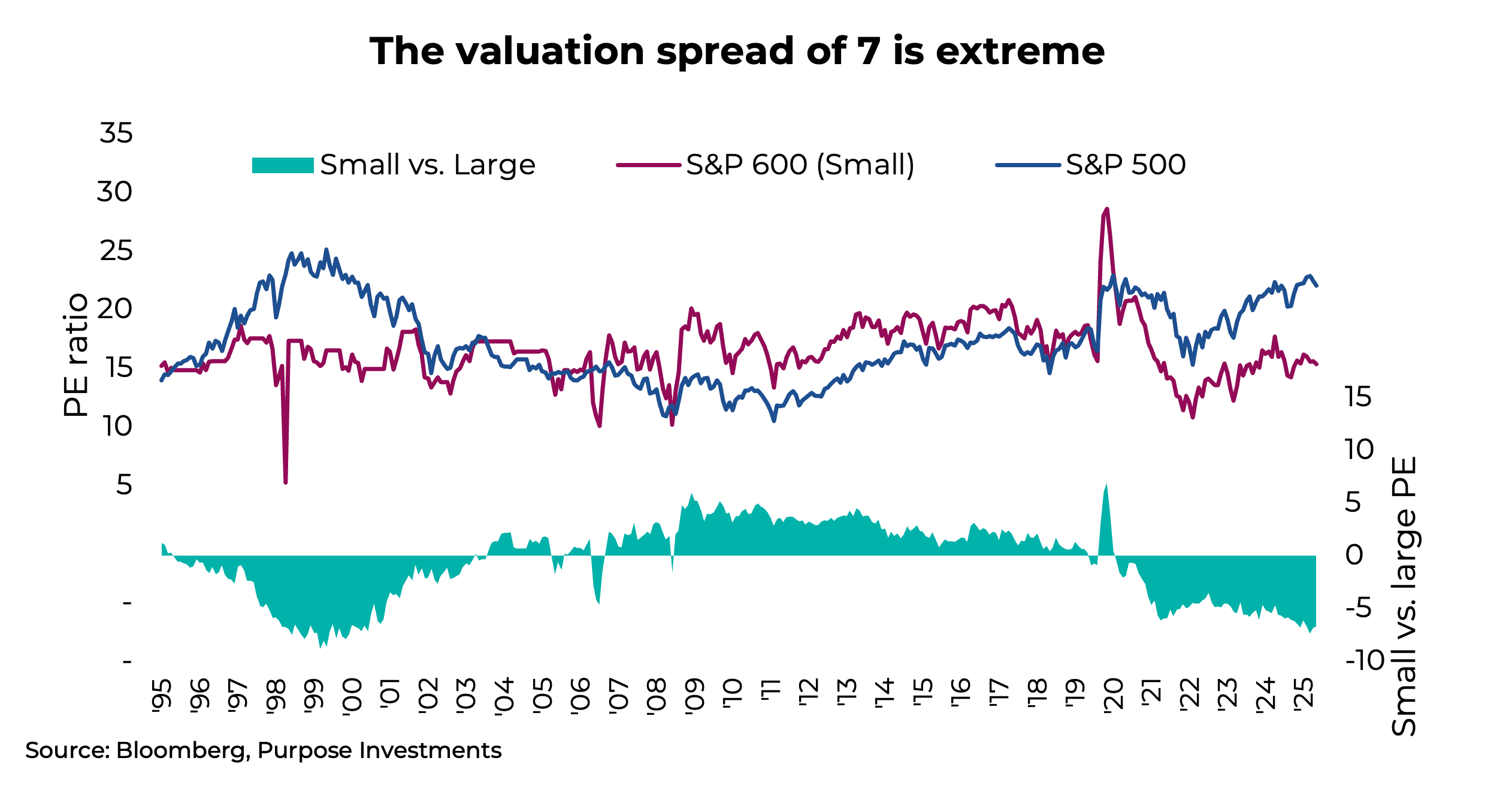

Valuations are a strong vote for future small cap outperformance, given the valuation spread. Based on consensus 12-month forward estimates, the large-cap S&P 500 is trading at 22x, while the smaller-cap S&P 600 is a more reasonable 15.3x. That spread is roughly at historical peak levels, so either large caps are too expensive or small caps are too cheap. This valuation spread level was also present at the end of the dot-com bubble, which kicked off a multi-year run of small cap outperformance.

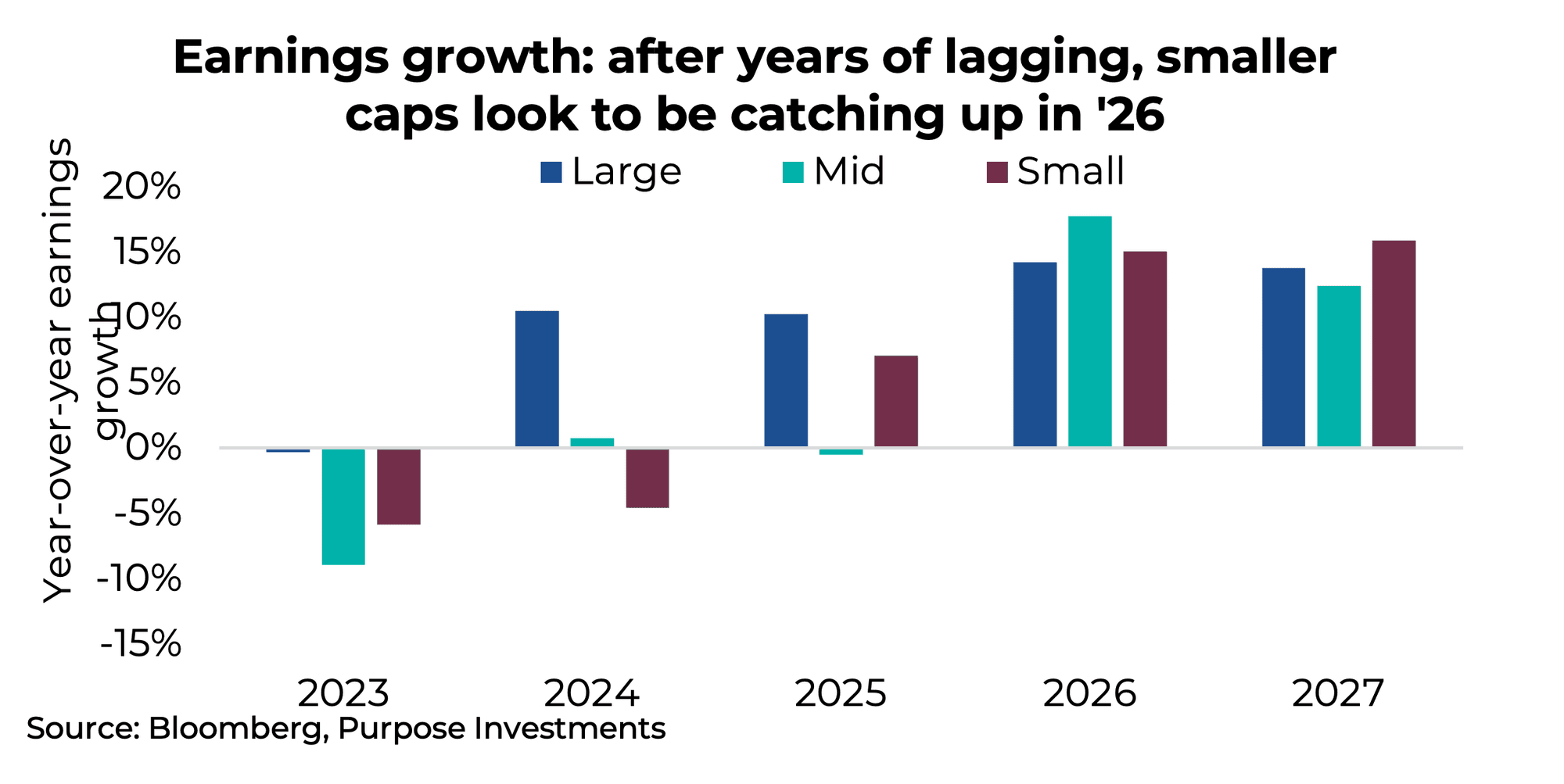

BUT, this valuation argument is not new. In fact, the valuations spread has proven persistent over the past few years, and it has clearly not led to small-cap outperformance. While valuation matters, so does earnings growth. If earnings are not growing, why would the market pay up with a higher multiple? And during the past few years, small-cap earnings growth has lagged behind large caps.

2026 does look more constructive for small and mid caps from an earnings growth perspective, but don’t get too excited. Revisions often land hard for smaller-cap companies, and the recent trend isn’t great. Over the past two months, the large cap S&P 500 consensus for 2026 has been revised higher by about +1.4%, a nice trend. Meanwhile, the S&P 600 small cap consensus earnings have declined by 2%.

Valuations certainly favour small caps, and with earnings growth forecasts much improved, the fundamentals are encouraging, with the caveat that revisions are a bit troubling.

The Economy: Do Small Caps Capture Growth?

This is where our view turns a little more challenging, but we’ll start with the good news. The Fed is cutting interest rates, which has historically been a positive for small-cap companies. In fact, the relative performance of size does correlate well with the steepness of the yield curve. When the curve steepens thanks to central bank cuts at the short end, or when the longer end moves higher due to improving economic growth prospects, small caps tend to outperform. Since mid-2023, the yield curve has been steadily steepening, yet small caps have not outperformed. A divergence such as this can often be followed by a catch-up. Financial conditions are certainly supportive of small caps.

U.S. economic growth composition is a challenge. The U.S. economy is growing well of late, but this growth is skewed toward corporate spending on data centres in an attempt to keep up with AI demand. Small-cap index composition has a greater weight to the U.S. consumer and less to information technology names. So generally, small caps aren’t in the sweet spot for the U.S. economy, as the consumer is under pressure. Adding to this is tariffs, which are starting to show an incremental impact on financials. While small caps do enjoy a higher percentage of sales domestically, input costs may be an issue given tariffs.

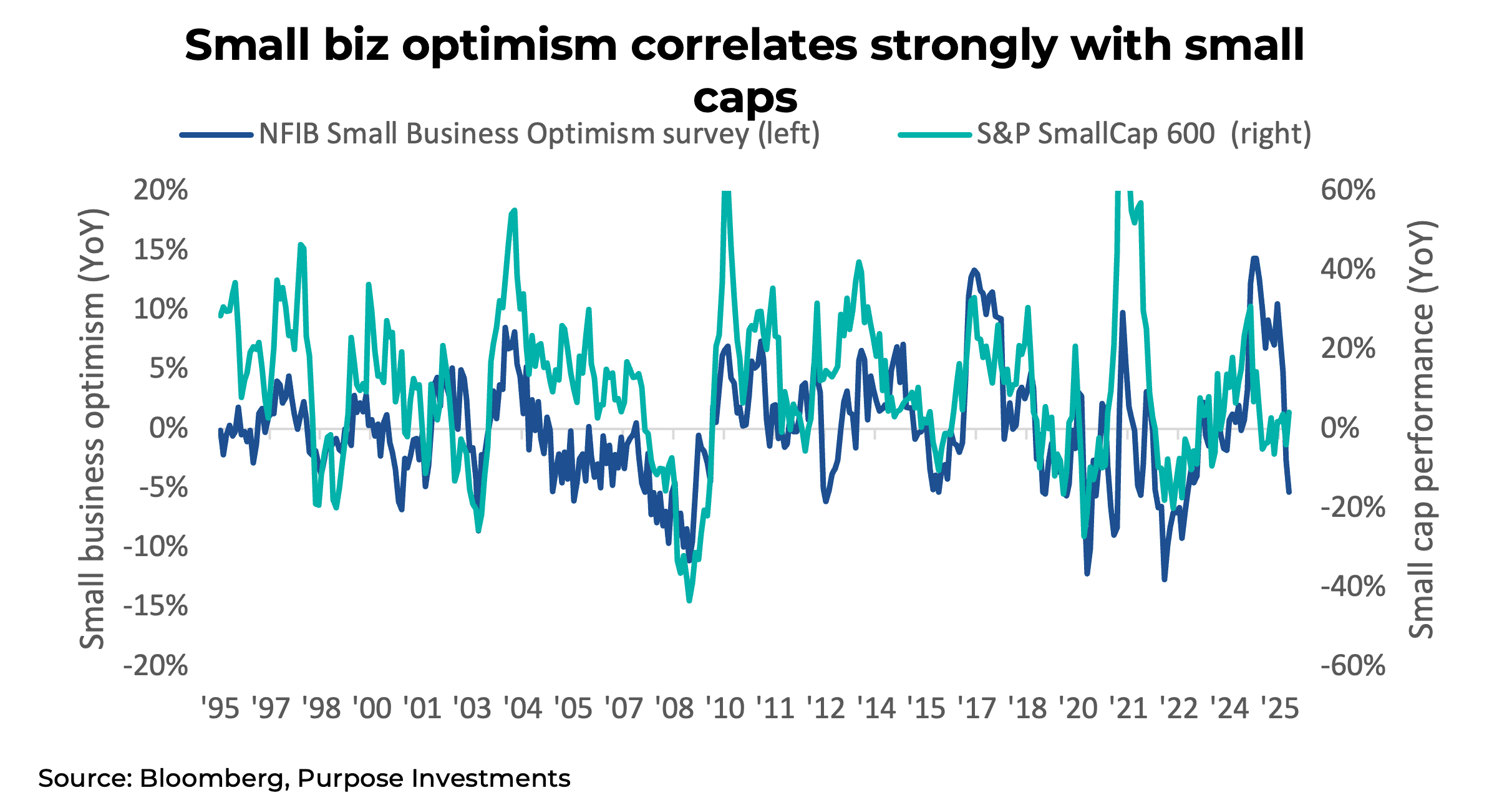

This is encapsulated in the National Federation of Independent Businesses (NFIB) small business optimism survey. This survey does correlate well with small-cap index performance, and the survey has turned pretty negative.

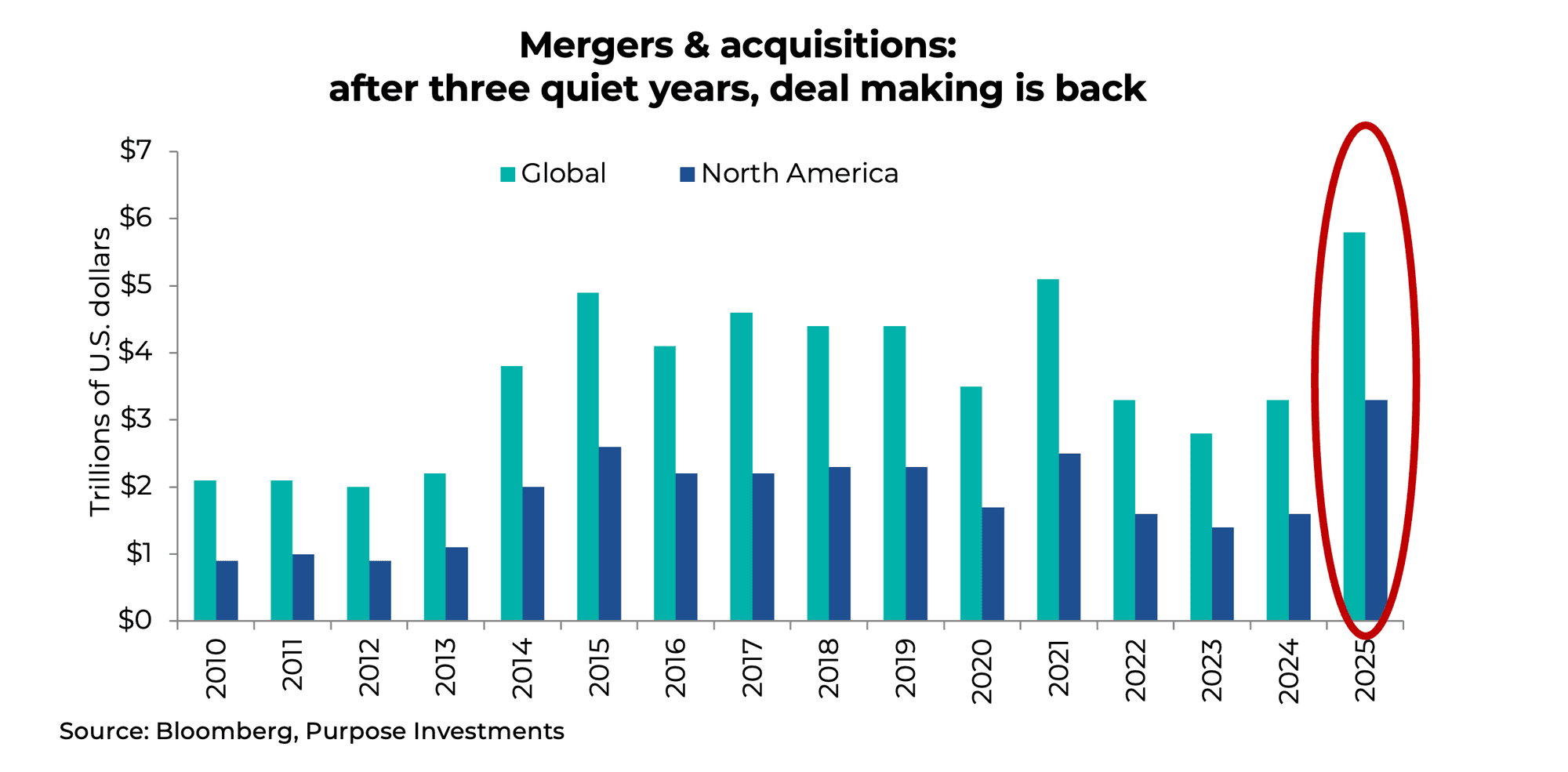

Mergers & Acquisitions: A Boon for Small Caps?

This is another good news story. M&A activity has been picking up. Few things help the performance of a small-cap name more than being purchased. Deal-making was rather suppressed globally from 2022–2024, but it started to reaccelerate in 2025. We believe this momentum will continue, which is good for smaller caps.

Final Thoughts

On balance, we’re a bit more constructive on smaller caps relative to past years. For now, we still prefer some equal-weight large-cap exposure in the U.S. to partially mitigate the high concentration risk, just not going down the size spectrum at this point. And we’re not alone: 2025 saw record ETF inflows, with large-cap equities absorbing $659 billion while small-cap ETFs suffered about $1 billion of outflows. That does entice the contrarian in us, perhaps if there were a pullback.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Get the latest market insights in your inbox every week.

Sources: Charts are sourced to Bloomberg L.P.

The content of this document is for informational purposes only and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document, and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable; however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed; their values change frequently, and past performance may not be repeated.

Certain statements in this document are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions, or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are, by their nature, based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on them. Unless required by applicable law, it is not undertaken, and is specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events, or otherwise.