“La la la... I can’t hear you!" A classic line from the great Canadian Jim Carrey, and a quote that perfectly encapsulates what might be the most prudent investment strategy in the months and years ahead.

Over the past six months, there has been a flurry of headlines, and having the ability to put your head in the sand and block out the noise has arguably never been more important. Throughout our discussions with high-profile investment teams, there has certainly been a lot of talk about how to respond to these headlines. Whether it’s the rising buzz around reducing Canadian equity exposure or the push to buy U.S. small caps, these are the trades making the rounds among investors. I won’t say they are marketing gimmicks because there is of course some validity to these ideas. However, when the main catalyst is due to the elevated level of political noise, we prefer to take a step back and remind ourselves of our investment process.

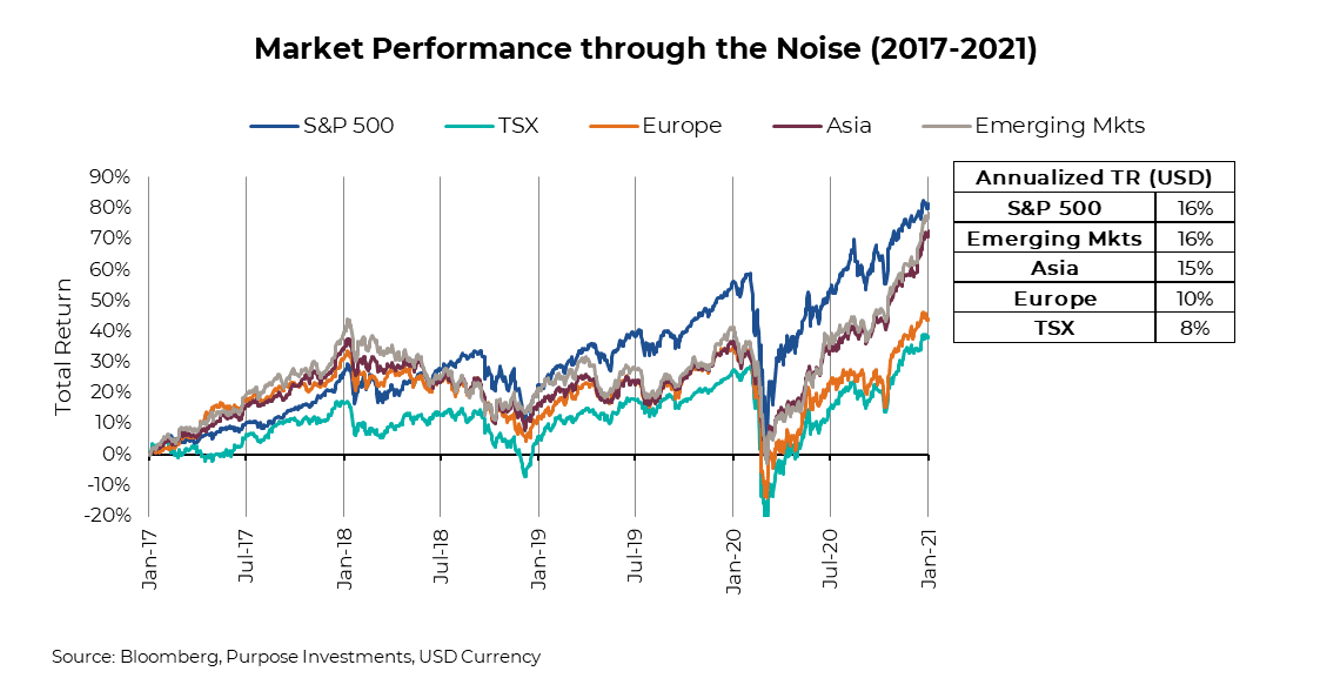

Over the next four years, remember that the market is not the economy. Yes, some of President Donald Trump's actions will ultimately have some effect on the market, but most will likely be fleeting. Throughout his first term (January 20, 2017 – January 20, 2021), the world was filled with market-moving events like tariffs, trade wars, lawsuits, tax cuts, and oh yeah… a global pandemic. Despite all that significant noise, the global markets performed pretty well…

Some of the actions were good for markets, and some very bad, but through it all, markets across the globe held strong. Yes, the S&P 500 was the winner throughout this term, but I bet not many thought emerging markets and Asia were right there alongside them. Especially when you consider the tariffs and rhetoric on China throughout that period. Keep in mind the S&P 500 was the winner the four years before and the four years after as well, so that was not a big change. In 2018, when the tariffs were announced, markets did take a tumble, but in the markets this news was very transitory, bouncing back and then some the following year. If you reacted to China tariffs in 2018 and sold all your emerging markets, you would have missed out on growth similar to the S&P 500.

This isn’t all to say that policies do not matter in investing; they certainly have an effect. But planning investment strategies around them can be very challenging and time-consuming. If you look at Trump 1.0, comments were made, and if the polls reacted negatively, they were never mentioned again. They intentionally disappeared from all discussions. In an extension of that, if something did become policy, a lot was rolled back and subsequently blamed on the soon-to-be-fired cabinet member. There are lots of reasons to believe this time may be different but, in all likelihood, it probably isn’t.

So, for portfolio managers, there are two paths forward, both of which have pros and cons.

1. Stay the course – If you choose to stay the course, this allows you to take a step back and assess the broad economic landscape. Even if certain risks appear dire, history shows that these headline disruptions will eventually pass. For example, if inflation returns, policy will likely dramatically shift. If policy doesn’t shift, the midterms likely won't be kind to the current regime.

This strategy allows investors to focus on the fundamentals, including earnings, valuations, and long-term growth. With so much speculation driving the headlines, staying disciplined puts you in a position to capitalize on overreactions, especially when market moves don’t align with underlying fundamentals.

2. Chase the noise – This path involves reacting to every new headline that arises. Which, in most cases, will mean urgently adjusting portfolios to avoid perceived short-term risks. To many, this might feel like you are staying ahead of the market, but a major drawback of this is the high demand for activity. Which ultimately forces investors into a never-ending cycle of deciding which news events require action and which should be ignored. That would be what we call a guessing game.

Markets, policies, and events are unpredictable. History shows that reacting to short-term news often leads to poor investment decisions. Chasing the noise might feel proactive, but ultimately, it will more than likely dilute returns, increase your stress, and make long-term success difficult to achieve.

With that said, both paths have the potential to be successful. It ultimately depends on the type of portfolio manager you aspire to be.

Policy change often sounds worse in headlines than it plays out in reality. A four-year term is short in market cycles, and sweeping economic changes rarely unfold as expected. By the time this is released, the latest concerns may already be forgotten, and that’s kind of the point. Market narratives shift quickly, but long-term opportunities remain. What feels urgent today often fades into the background, replaced by the next big headline.

Final Thoughts

Every cycle brings new headlines, new fears, and new reasons to believe this time is different. But history tells us otherwise. Markets adapt, businesses adjust, and economies keep moving forward. The investors who stay disciplined, focus on fundamentals, and take advantage of overreactions are the ones who ultimately succeed. The ability to tune out the noise isn’t just a skill; it’s a competitive advantage.

Will it always be easy? No.

“So you’re telling me there’s a chance?” Absolutely.

— Brett Gustafson is an Associate Portfolio Manager at Purpose Investments

Sources: Charts are sourced to Bloomberg L.P.

The content of this document is for informational purposes only, and is not being provided in the context of an offering of any securities described herein, nor is it a recommendation or solicitation to buy, hold, or sell any security. The information is not investment advice, nor is it tailored to the needs or circumstances of any investor. Information contained in this document is not, and under no circumstances is it to be construed as, an offering memorandum, prospectus, advertisement or public offering of securities. No securities commission or similar regulatory authority has reviewed this document and any representation to the contrary is an offence. Information contained in this document is believed to be accurate and reliable, however, we cannot guarantee that it is complete or current at all times. The information provided is subject to change without notice.

Commissions, trailing commissions, management fees, and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated. Certain statements in this document are forward-looking. Forward-looking statements ("FLS") are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as "may," "will," "should," "could," "expect," "anticipate," intend," "plan," "believe," "estimate" or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained in this document are based upon what Purpose Investments and the portfolio manager believe to be reasonable assumptions, Purpose Investments and the portfolio manager cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.